portability estate tax return

I The executor states affirmatively on a timely filed estate tax return or in an attachment to that estate tax return that the estate is not electing portability under section 2010c5. You will want to be aware that portability may not be the right decision for your situation if for example you choose to divide your assets.

Form 706 Extension For Portability Under Rev Proc 2017 34

To use the DSUE the estate must timely file an Estate Tax Return when the first spouse passes away and the portability election must also be properly completed.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

. In order to elect portability a surviving spouse must file an estate tax return Form 706 for the federal estate tax and Form MET-1 for the. Where the gross estate does not exceed the basic exclusion amount and filing a Federal estate tax return is only required for the purpose of making the portability election additional extension relief may be applied for under. Portability is the ability for the surviving spouse to use the deceased spouses unused estate and gift tax exclusion after the deceased spouses death.

642 million taxable estate x 40 estate tax rate 2568 million in taxes due The Estate Tax With Portability Lets assume the same scenario. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make. Portability Lets address the elephant in the room.

Their home bank accounts a second home investment accounts cars etc. Two important aspects to remember are that the portability exemption is only available to married couples and only applies to Federal estate taxes. In other words for DSUE portability to be claimed the executor must elect portability on the deceased spouses estate tax return.

If the executor timely files the decedents Form 706 United States Estate and Generation-Skipping Transfer Tax Return which generally is due nine months after the decedents date of. That can be a rather substantial tax benefit and alone can enable most married Americans that would be subject to an. To make the DSUE available to the surviving spouse the Executor of the estate of the first spouse to die must file a federal estate tax return and make an election for the DSUE to transfer to the surviving spouse even if the estate of the first spouse is under 11400000 and otherwise would not require a federal tax return be filed.

In other words it could not be relied upon. Bob and Sue are married and have all of their assets jointly titled. The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of.

The filing of a Federal estate tax return will nonetheless be required in order to make a portability election. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. The option of portability can make a significant difference when it comes to taxation of an estate.

Until 2012 portability was part of a law that had been set to sunset. The word estate in planning doesnt have anything to do with the size of your home. Assets Must File Estate Tax Returns to learn more.

Portability is the right of an executor to transfer or port the unused estate tax exemption from the first spouse to die to the second spouse to die. Citizen if the decedent had US-situated assets. For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021.

Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. The IRS thankfully has made electing portability easy. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months.

Refer to Some Nonresidents with US. Estate tax return preparers who prepare a return or claim for refund which reflects. This is called the deceased spouses unused exemption or DSUE.

The manner in which the executor may make this affirmative statement on the estate tax return is as set forth in the instructions issued with respect to such form Instructions for Form 706. The IRS has subsequently issued Revenue procedure 2017-34 that supersedes prior regulations and sets forth a new process to obtain a late portability election if the decedent was not otherwise required to file an estate tax return because their gross estate in addition to any taxable gifts does not exceed the applicable exclusion amount. Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return.

It simply refers to a persons assets. An estate tax return may need to be filed for a decedent who was a nonresident and not a US. Portability was intended to simplify estate.

An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax for 2021. As a result the increase in the estate and gift tax exemption to 10000000 is scheduled to sunset on December 31 2025 at which time the exemption will return to 5000000 and with the cost.

Portability has been part of the law since late in 2010. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. The federal estate tax says The Times Herald in the article Federal estate.

These steps could be easily overlooked since an Estate Tax Return does not necessarily have to be filed if the estate is below the exemption amount. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the surviving. The election to transfer a DSUE amount to a surviving spouse is known as the portability election.

Filing Deceased Estate Tax Return In Ny Burner Law Group

Preparing Form 706 The Federal Estate Tax Return Youtube

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Deceased Spousal Unused Exclusion Dsue Portability

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner

Emily S Virtual Rocket Donald Trump Supreme Court Won T Stop Grand Jury Irs Tax Forms Tax Forms Income Tax Return

Your Beloved Spouse Just Died How To Deal With The Estate Tax

Will My Executor Be Required To File An Estate Tax Return Vermillion Law Firm Llc Dallas Estate Planning Attorneys

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

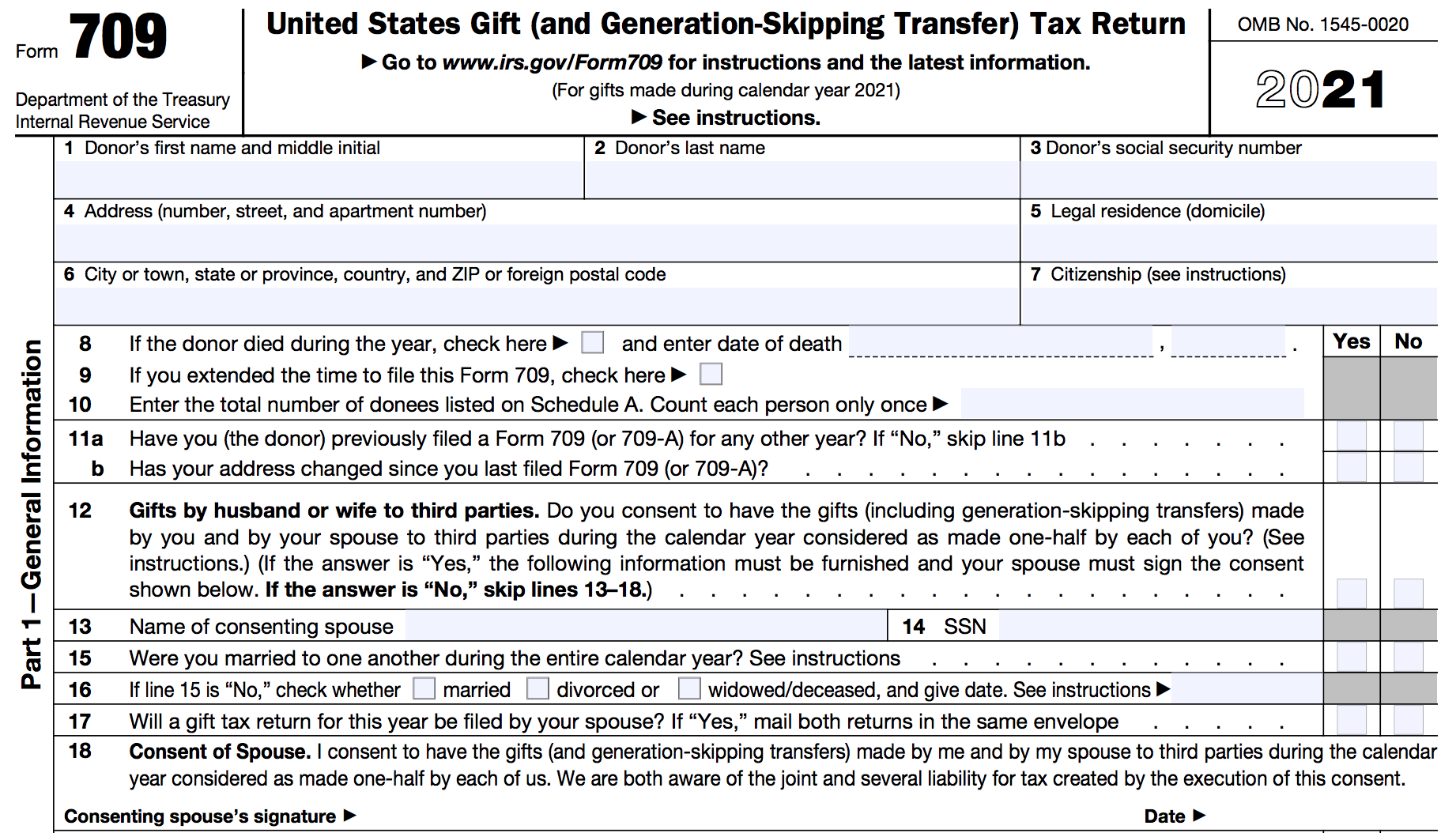

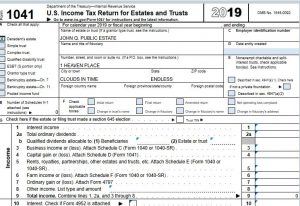

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Irs Forms 1040 Google Search Irs Tax Forms Tax Forms Income Tax Return

Special Rule Of Regulations Section 20 2010 2 A 7 Ii Trust Me I M A Lawyer

Estate Tax Return Form 706 Trust Me I M A Lawyer

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

File Form 706 Federal Estate Tax Return By Patti Spencer Estategenie Blog

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation